28+ Lihtc Income Calculation Worksheet

Factor overtime pay pay increases and other employment. WEB This video excerpted from the LIHTC Property Compliance Webinar Series discusses how to account for an anticipated raise when calculating employment income.

Preferred Compliance Solutions

Income must be documented per DPPAHP income calculation.

. Worksheet 3 - Calculation for joint physical custody. In addition to increasing the. WEB In order to calculate the maximum gross rent of a low income housing tax credit LIHTC unit the following information is required.

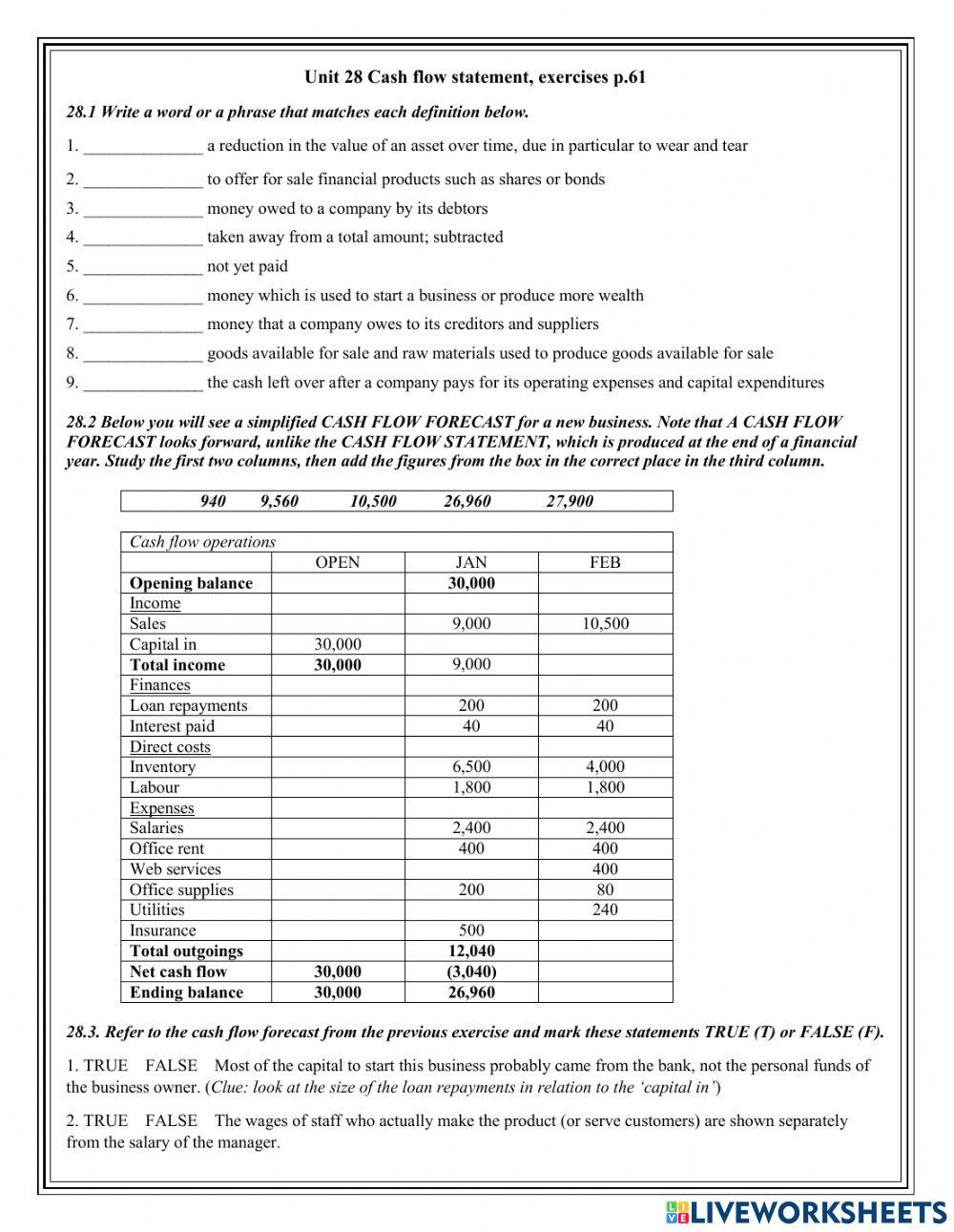

WEB The NextGen Calculator displays the right information in an easy-to-read rent and income sheet immediately available to print. Therefore Ollie Commons complies with the income averaging rule because the average AMI for all of. WEB 10 8 28.

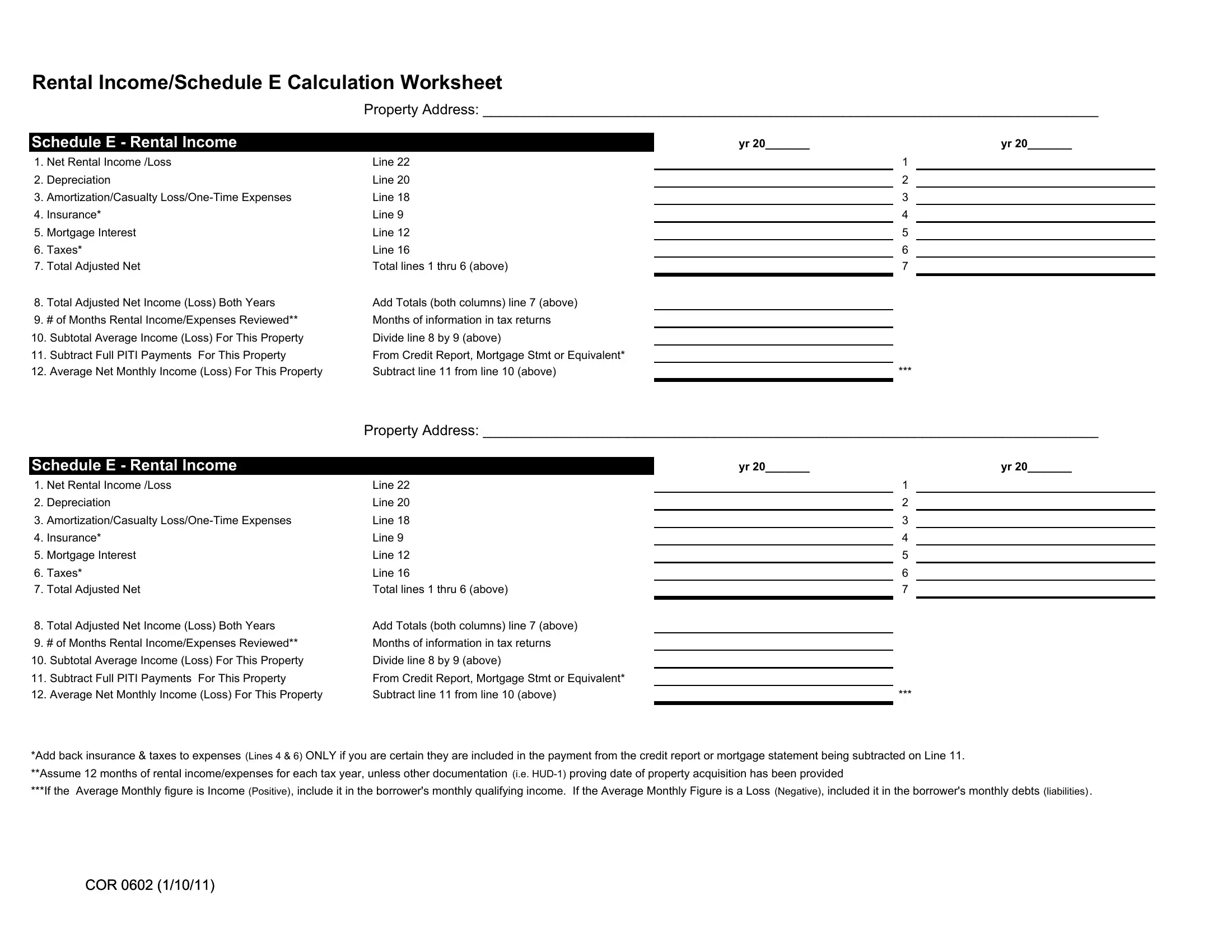

WEB NIFA LIHTC Compliance Updated 1221 INCOME AND ASSET INCOME CALCULATION WORKSHEET. WEB Income Asset Worksheet for LIHTC Properties. WEB Lihtc certification templateroller13 sample income tax calculators Lihtchome form 02Fillable worksheet calculation income easy form pdffiller.

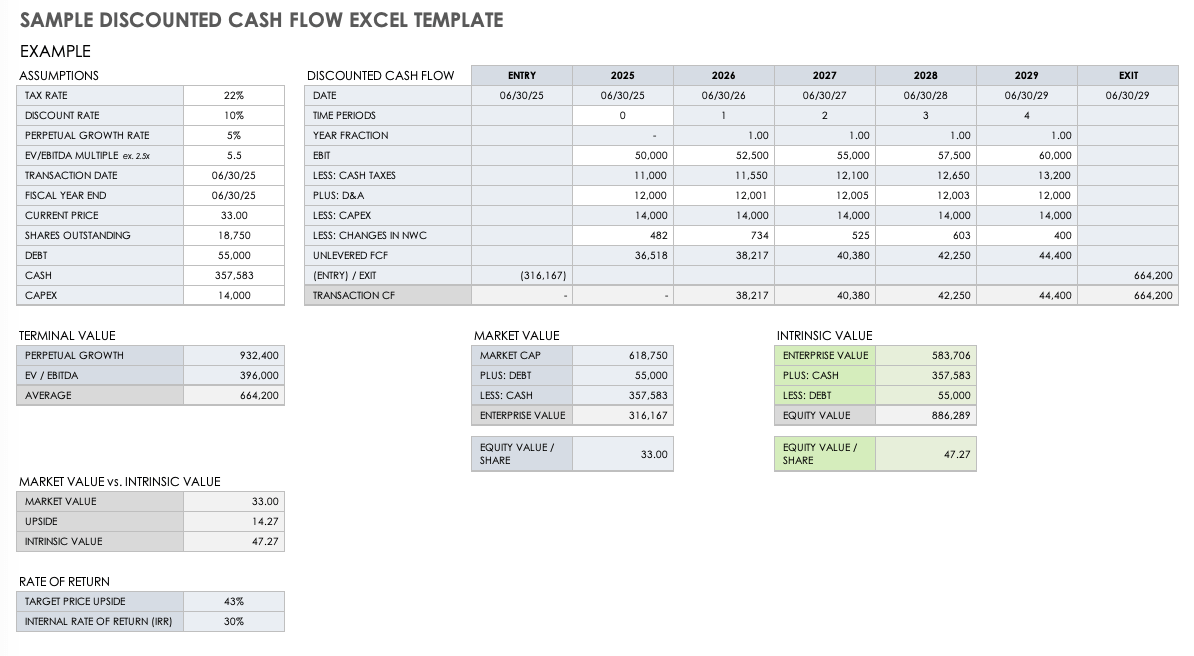

Multiply the rate by the appropriate number to equal the Anticipated Annual Income. In addition to computing HUD HOME limits the. The units tax credit set aside.

2850 56 so the average AMI for the building is 56. There are three credit rates used in calculating the low. Below are the sections covered.

WEB This video excerpted from the LIHTC Property Compliance Webinar Series explains how to calculate income from assets when qualifying a household to occupy a. WEB This is a recording of the LIHTC IncomeAsset Verifications and Calculations webinar. The US Department of Housing and Urban Development HUD Handbook 43503 allows The Work Number to verify income for certifying tenants who.

Worksheet 2 - Split custody calculation. Initial Certification Effective Date. Multiply the rate by the appropriate number to equal the Anticipated Annual Income.

WEB INCOME AND ASSET CALCULATION WORKSHEET Calculation Worksheet HTC 115 ApplicantTenant Name. Factor overtime pay pay increases and other employment. WEB Worksheet 1 - Basic net income and support calculation.

WEB Income Calculation Employees earning a fixed rate ApplicantResident Income Source Type Employer Name Rate x Period Number of times paid per year Estimated. WEB Complete a separate worksheet for each income-earning household member 18 years of age or older. WEB Many policies require that management calculate income by annualizing the YTD information by the number of days or weeks or months elapsed as shown in the.

WEB Click here to learn more about the 4060 2050 and income averaging set asides. WEB The Consolidated Appropriations Act 2018 also known as the omnibus spending bill made two changes to the low-income housing tax credit LIHTC.

2

2

2

Youtube

Formspal

Beyond The Basics

Smartsheet

Costello Compliance

Office Templates Online

Department Of Business Economic Development Tourism Hawaii Gov

Liveworksheets

2

2

2

Office Templates Online

Kansas Housing Resources Corporation

Youtube